CBP Targets Battery Tech for UFLPA Enforcement

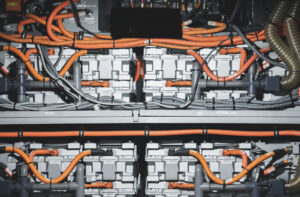

Customs and Border Protection (CBP) recently indicated potential increased scrutiny of battery technology under the Uyghur Forced Labor Prevention Act (“UFLPA,” or the “Act”). Although the Act covers essentially all trade touching China’s Xinjiang region, it specifically lists cotton, polysilicon, and tomatoes as high-priority sectors for enforcement. Recent CBP actions indicate battery technologies are also in CBP’s sights, reflecting UFLPA’s broad scope and increased Congressional scrutiny of these supply chains.

In December 2022 Senate Finance Committee Chair Ron Wyden (D-Oregon) launched an investigation into eight automakers’ potential links to China’s Xinjiang region (allegedly to source parts, including batteries, wiring and wheels). In March 2023, Senator Wyden sent follow-up letters to eight leading automakers, which echoed recent calls from Biden Administration officials that importers ensure their entire supply chains – from raw materials to finished goods – are free from forced labor.

Congress’s attention on batteries and the automotive industry follows a 2022 report by Sheffield Hallam University, which highlighted that “China processes most of the world’s iron into steel, bauxite into aluminum, and lithium and cobalt into battery grade materials.” Additionally, the US Department of Labor added lithium-ion batteries to its most recent list of goods produced by child or forced labor in September 2022:

“[The Bureau of International Labor Affairs] has reason to believe that lithium-ion batteries manufactured in China are produced with an input produced with child labor, specifically cobalt ore mined in the Democratic Republic of the Congo (DRC). . . . Cobalt is used in the production of nearly all lithium-ion batteries. The DRC produces the majority of the world’s cobalt. Most cobalt-producing mines in the DRC are owned or financed by Chinese companies.”

Shipments of electronics, apparel, industrial and manufacturing materials, and agriculture industries – which include UFLPA’s current high priority sectors of cotton, polysilicon, and tomatoes – have seen the most detentions under UFLPA to date. Collectively these industries account for $687 million worth of shipments denied or under review by CBP since UFLPA came into force in June 2022. According to reports, CBP recently updated its standard detention notice form to include the kinds of documents that should be submitted as part of an effort to release a battery-related shipment – indicating that it has already set its sights on this sector as well.

Shipments of electronics, apparel, industrial and manufacturing materials, and agriculture industries – which include UFLPA’s current high priority sectors of cotton, polysilicon, and tomatoes – have seen the most detentions under UFLPA to date. Collectively these industries account for $687 million worth of shipments denied or under review by CBP since UFLPA came into force in June 2022. According to reports, CBP recently updated its standard detention notice form to include the kinds of documents that should be submitted as part of an effort to release a battery-related shipment – indicating that it has already set its sights on this sector as well.

Notably, CBP reported UFLPA detentions in the “automotive and aerospace” industry for the first time in the second quarter of 2023, which may reflect an increase in congressional concerns in the preceding quarter. We cannot confirm whether the twenty-two actions reported to date in the automotive and aerospace sector are limited to car batteries. But CBP may well be motivated to exhibit its willingness and capacity to act on automotive batteries to leverage lawmakers’ combined concerns on China and supply chains during the tight appropriations season. Yet, CBP’s enforcement zeal may be tapered by some interagency officials to ensure there are no significant impacts to domestic clean energy supply chains.

We have learned, while interacting with CBP on UFLPA matters, it is best for importers to proactively implement systems that (i) align compliance standards across tiers of their supply chains and (ii) collect CBP materials typically requests from importers to overcome UFLPA’s rebuttable presumption that imports touching Xinjiang, or an entity on the UFLPA Entity List, are prohibited from entering the United States.

For our previous blog entries on the UFLPA and its implementation, see posts here.